The financial data used to create these have a lot of crossovers, but they look at different aspects of a business. Converted into a percentage, this leaves the beauty company with a 44% contribution margin on its skincare product. Variable costs tend to represent expenses such as materials, shipping, and marketing, Companies can reduce these costs by identifying alternatives, such as using cheaper materials or alternative shipping providers. Textbook content produced by OpenStax is licensed under a Creative Commons Attribution-NonCommercial-ShareAlike License . Finding an accountant to manage your bookkeeping and file taxes is a big decision.

- This $50 is what you have left to pay for things that don’t change in cost, like your lemonade stand’s spot on the sidewalk, and then to keep as profit.

- Request a free demo and see how Cube can help you save time with all your contribution margin income statements, reports, analysis, and planning.

- Managerial accountants also use the contribution margin ratio to calculate break-even points in the break-even analysis.

- There are three primary benefits to the preparation of a contribution income statement.

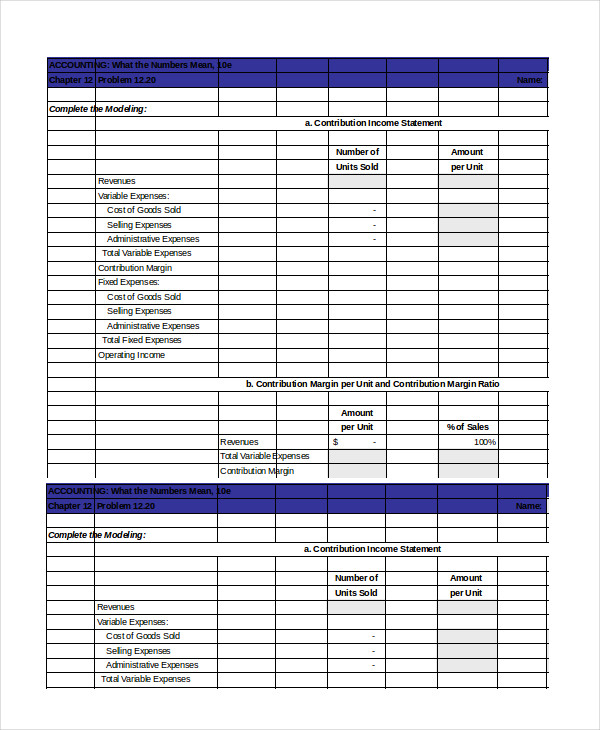

- The following simple formats of two income statements can better explain this difference.

Contribution Margin: What It Is, How to Calculate It, and Why You Need It

Fixed costs are costs that may change over time, but they are not related to the output levels. These costs include equipment rent, building rent, storage space, or salaries (not related directly to production. If they are, you count them as variable costs). As shown in the formula above, the formula for EBIT involves taking company sales revenue, and expenses, without breaking this down into individual products or services. Fixed costs are costs that are incurred independent of how much is sold or produced.

4: The Contribution Margin Income Statement

If they exceed the initial relevant range, the fixed costs would increase to \(\$400\) for nine to sixteen passengers. Variable expenses fluctuate based on the business’s usage or output, such as utility bills or raw materials. Fixed production costs, such as rent or salaries, remain constant, regardless of business activity or output. A low margin typically monitor cash positions and manage liquidity camden national bank means that the company, product line, or department isn’t that profitable. An increase like this will have rippling effects as production increases. Management must be careful and analyze why CM is low before making any decisions about closing an unprofitable department or discontinuing a product, as things could change in the near future.

Contribution margin income statements: a complete guide

Investors and analysts may also attempt to calculate the contribution margin figure for a company’s blockbuster products. For instance, a beverage company may have 15 different products but the bulk of its profits may come from one specific beverage. The following examples explain the difference between traditional income statement and variable costing income statement.

In our example, the sales revenue from one shirt is \(\$15\) and the variable cost of one shirt is \(\$10\), so the individual contribution margin is \(\$5\). This \(\$5\) contribution margin is assumed to first cover fixed costs first and then realized as profit. The contribution margin income statement separates the fixed and variables costs on the face of the income statement. This highlights the margin and helps illustrate where a company’s expenses. Variable expenses can be compared year over year to establish a trend and show how profits are affected.

Here, we focus on the contribution margin, which looks at how sales cover both fixed and variable costs. Fixed costs are expenses that don’t change, like rent, while variable costs go up or down based on how much a company makes or sells, like materials. At a contribution margin ratio of \(80\%\), approximately \(\$0.80\) of each sales dollar generated by the sale of a Blue Jay Model is available to cover fixed expenses and contribute to profit.

The resulting value is sometimes referred to as operating income or net income. Contribution margin income statements are useful barometers for businesses on whether clear skies are ahead or if they need to hunker down for a storm. It’s also a cornerstone of contribution margin analysis, giving enormous insight into a business’s overall financial position. Based on the contribution margin formula, there are two ways for a company to increase its contribution margins; They can find ways to increase revenues, or they can reduce their variable costs.

It represents the incremental money generated for each product/unit sold after deducting the variable portion of the firm’s costs. We handle the hard part of finding the right tax professional by matching you with a Pro who has the right experience to meet your unique needs and will manage your bookkeeping and file taxes for you. In this section, we’re going to learn how to figure out something called the contribution margin. This is a really important number that tells a company how much money is left after paying for things that change in cost, like materials to make a product. A university van will hold eight passengers, at a cost of \(\$200\) per van.

Thus, 20% of each sales dollar represents the variable cost of the item and 80% of the sales dollar is margin. Just as each product or service has its own contribution margin on a per unit basis, each has a unique contribution margin ratio. Contribution margin is the amount of sales left over to contribute to fixed cost and profit. Contribution margin can be expressed in a number of different ways, including per unit and as a percentage of sales (called the contribution margin ratio).